Instant payment solutions revolutionize how we manage money, demanding only seconds to complete a transaction. In this article, unravel the premier services of 2024 and their distinct features, and get a firsthand look at how they elevate your transaction process so you can make an informed choice swiftly.

Key Takeaways

- Apple Pay, Google Pay, Zelle, and Samsung Pay are the top instant payment solutions in 2024, each offering distinctive features from seamless integration to supporting international transactions and various security measures.

- Important factors when considering instant payment solutions include understanding transaction limits, fee structures, security measures such as encryption and tokenization, and ensuring the platform is user-friendly for a seamless transaction experience.

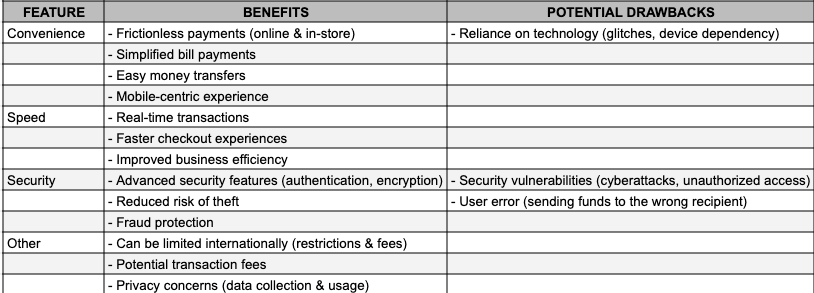

- Despite their benefits in speed and convenience, instant payment solutions can have drawbacks, such as the potential for technical glitches and security vulnerabilities; users must take precautions, such as using multi-factor authentication and keeping software up-to-date.

Top Instant Payment Solutions of 2024

Navigating the sea of instant payment solutions can be overwhelming, with numerous offerings each boasting unique features and benefits. This year, four platforms have emerged as leaders in the field, namely:

These platforms, including other mobile payment apps, offer a range of features such as peer-to-peer payments, easy fund transfers to bank accounts, request money functionality, and mobile payment services.

Apple Pay

Apple Pay, deeply integrated into Apple’s ecosystem, offers a seamless payment experience for Apple users. Its features include:

- Seamless payment experience for Apple users

- Acceptance by more than 85% of US retailers

- International in-store payments in 26 countries

- Compatibility with rewards cards

These features make Apple Pay a comprehensive solution for Apple users.

Google Pay

Google Pay is another top contender, extending beyond simple transactions to store various digital items like transit cards, driver’s licenses, and state IDs in Google Wallet. Accepted across over 180 countries, Google Pay supports major credit and debit cards, including debit cards from various providers, making it a versatile choice for users worldwide.

Zelle

Zelle, integrated with most US banks, simplifies personal transactions, such as paying back friends or family for shared expenses. Although it does not offer an in-store payment option and lacks features for international payments, it compensates by being free for personal purchases within the US.

Samsung Pay

Samsung Pay is a robust mobile payment service available on multiple Samsung devices. It offers Samsung Rewards points for transactions and facilitates international in-store payments in 17 countries, making it an attractive option for Samsung device users. One might wonder how Samsung Pay works, and the answer lies in its seamless integration with these devices and user-friendly interface.

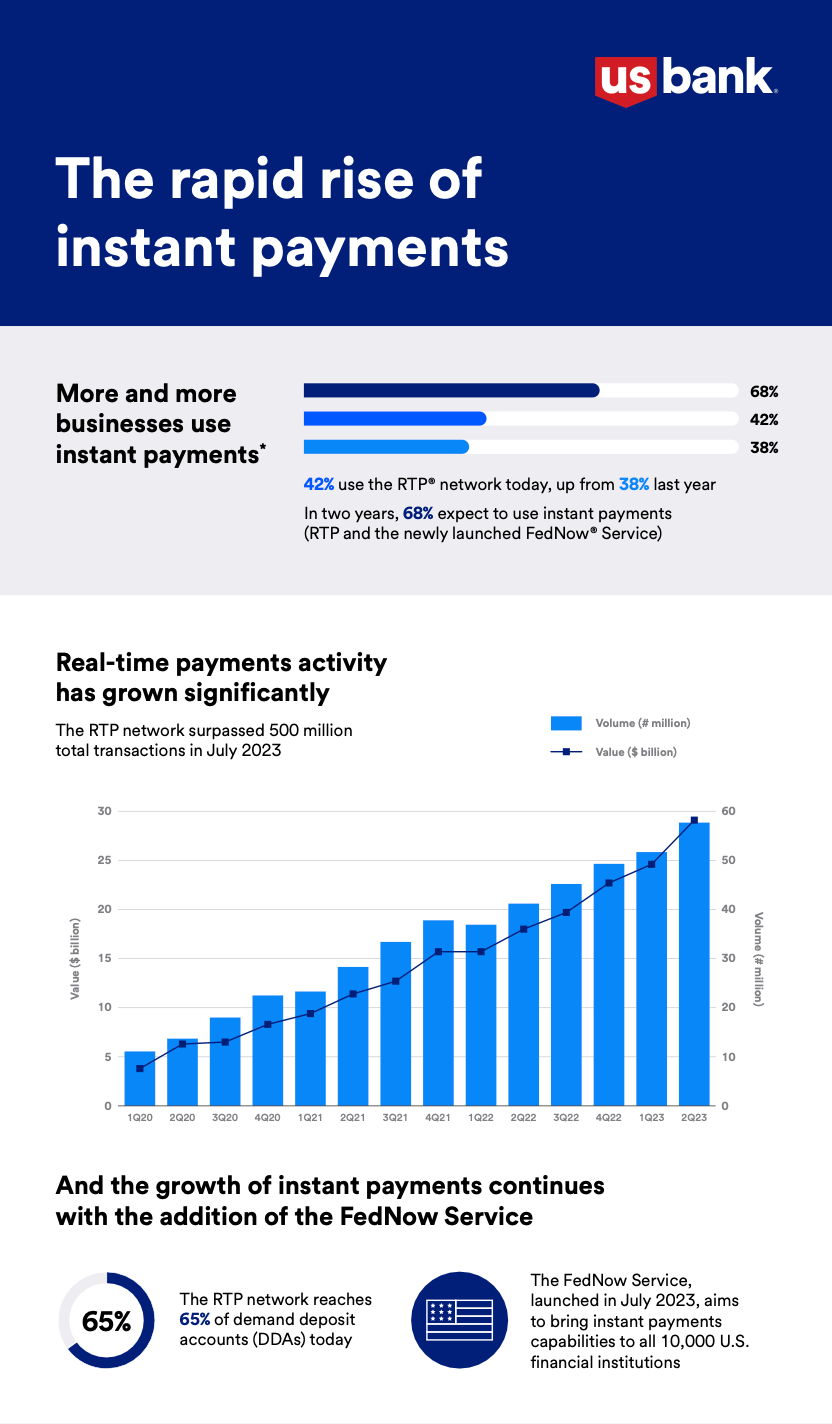

Instant Payments on the Rise: Transforming Businesses

(link to complete infographics by US Bank)

Businesses are embracing instant payments:

Usage is soaring, with 68% expecting to use them in two years.

- Real-time transactions are booming, exceeding 500 million monthly.

- The FedNow Service expands its reach to all US financial institutions.

Consumer-focused sectors lead:

- 81% of retail and hospitality businesses plan to adopt instant payments.

- Improved customer experience and working capital are key drivers.

Beyond instant payments:

- Zelle®, Venmo®, and virtual cards are rapidly being adopted in consumer industries.

The future holds promise:

- Experts predict unforeseen innovations powered by instant payments.

- Embedding and integration are crucial for accelerating adoption.

- Instant payments are vital to meet consumer demand for immediacy.

Features to Look for in Instant Payment Solutions

While the aforementioned platforms lead the pack, it’s crucial to consider specific features when selecting an instant payment solution. Key factors to consider include:

- Transaction limits

- Fees

- Security measures

- User-friendliness

These elements can significantly impact user experience and the overall value provided by the platform.

Transaction Limits

Transaction limits vary among different instant payment solutions and can potentially lead to inconveniences and financial burdens. For instance, Zelle’s transaction limits are set by the associated bank, while Google Pay and Apple Pay have their own set limits.

It is essential to understand these limits to ensure they align with your financial needs.

Fees

The fee structure is another critical factor to consider. Instant payment solutions like Zelle and Google Pay do not charge additional transaction fees for users. However, services like Apple Cash and PayPal may impose fees for instant transfers or for transactions using a credit card.

Being aware of these costs can help minimize unnecessary expenditures.

Security Measures

Security is paramount when it comes to instant payment solutions. Features such as encryption and tokenization secure data, while multi-factor authentication verifies user identity more reliably.

Advanced fraud detection systems employ algorithms and real-time analysis to identify unauthorized activities, adding another layer of protection.

User-Friendliness

Lastly, the user-friendliness of the platform significantly impacts the user experience. Platforms like PayPal are favored by first-time users for their simple setup and familiarity, which encourages customer purchase completion.

The ability to navigate the app easily and conduct transactions smoothly is an essential feature to look for in the best mobile payment app solution, including a reliable mobile payment app among various payment apps.

How Instant Payment Solutions Work

Understanding the inner workings of instant payment solutions can enhance your usage experience. Instant payment platforms like the FedNow Service provide the necessary infrastructure that allows banks and credit unions to offer their customers instant payment services.

These services operate round the clock, ensuring that users have access to instant payment services anytime, anywhere.

Linking Bank Accounts and Cards

One of the first steps in using an instant payment solution is linking your bank account or card. This can be done manually by entering banking credentials or using a test deposit verification method. Having a linked bank account enhances ease of transactions, as seen with Google Pay, which enables users to add money to their balance and transfer funds out.

Processing Transactions

Once your bank account or card is linked, the instant payment solution can process transactions typically in five to 30 seconds, depending on system availability and bank types. This speed of processing is a distinguishing feature of instant payment solutions, drastically reducing the time it takes to transfer funds compared to traditional banking methods.

Benefits of Using Instant Payment Solutions

Using instant payment solutions brings several benefits, including convenience, speed, and enhanced security for online purchases. These platforms empower users to make transactions from any location, connecting them directly to billers and money sources like banks and digital wallets for immediate transactions.

Convenience

Instant payment solutions, such as the instant payment system, offer unparalleled convenience. They provide a non-stop available service, allowing users to perform a variety of payment transactions, including transfers, deposits, withdrawals, bill payments, and purchases using their mobile phones or computers. The services also enhance user experience by offering features such as tracking payment status, automating recurring payments, and setting up payment reminders.

Speed

Speed is another major advantage of instant payment solutions. They process transactions significantly faster than traditional banking methods, operating in near real-time. This rapid execution extends to a variety of financial transactions, including peer-to-peer transfers and loan repayments.

Enhanced Security

Instant payment solutions prioritize user security. They implement advanced security measures such as encryption, tokenization, and multi-factor authentication to protect users. By using digital wallets, payment information is stored in a secure digital environment, reducing the potential exposure of sensitive details.

Potential Drawbacks of Instant Payment Solutions

Despite the numerous benefits, it’s essential to be aware of potential drawbacks when using instant payment solutions. These platforms rely heavily on technology, which can lead to transaction failures in times of technical glitches or if the user’s device is not operating properly.

Reliance on Technology

Heavy reliance on technology can sometimes lead to issues. Technical glitches can result in transaction interruptions and frustration among users. Additionally, internet connectivity problems can cause delays or incomplete transactions, compromising the reliability of instant payments.

Regularly updating devices and software can help avoid these issues and ensure a smoother transaction process.

Security Vulnerabilities

Despite the advanced security measures in place, instant payment solutions are not immune to security vulnerabilities. Risks of unauthorized transactions, cyberattacks, and fraud are present. However, users can protect themselves by:

- Implementing multi-factor authentication

- Using a VPN

- Verifying the legitimacy of payment recipients

- Ensuring mobile banking or wallet apps are authentic.

Quick Comparision

International Mobile Payments and Fees

International mobile payments are another aspect to consider when exploring instant payment solutions. Certain platforms support international transactions, enabling easy access to global markets. However, it’s important to note that such transactions typically incur higher fees.

Supported Apps

Apps like Xoom, PayPal, Samsung Pay, and Cash App offer solutions for users needing to make international transactions. Xoom, a service offered by PayPal, handles international transactions and reaches 131 countries, making it a valuable tool for global transactions.

Fees

Fees associated with international transactions can significantly vary depending on the country and service used. For example, PayPal charges a fee of 5% for personal international transactions, while Xoom’s fees depend on the country and the method of transfer.

Being aware of these fees can help users choose the most cost-effective solution for their needs.

Summary

In conclusion, instant payment solutions have greatly simplified how we manage and transfer money. With a plethora of options available, it’s important to consider key factors such as transaction limits, fees, security measures, and user-friendliness when selecting a platform. Despite potential drawbacks like reliance on technology and security vulnerabilities, the benefits of convenience, speed, and enhanced security make instant payment solutions an indispensable tool in our increasingly digitalized world.

Frequently Asked Questions

What is a mobile payment app?

A mobile payment app is a digital platform that enables financial transactions through smartphones and other mobile devices, allowing users to pay for goods and services without cash or cards. It provides a convenient way to make payments and transfer money using a portable electronic device.

What app can I use to take payments?

You can use digital wallets and payment apps to take payments for your business. These apps provide a convenient and secure way for your customers to pay for your products or services.

What are some top instant payment solutions in 2024?

In 2024, some of the top instant payment solutions are Apple Pay, Google Pay, Zelle, and Samsung Pay. These platforms offer convenient and efficient payment options for users.

How do instant payment solutions work?

Instant payment solutions work by linking your bank account or card and processing transactions in near real-time, utilizing infrastructure provided by services like the FedNow Service. This allows for quick and seamless transactions, enhancing the overall payment experience.

What are some benefits of using instant payment solutions?

Using instant payment solutions offers convenience, speed, and enhanced security, allowing users to make transactions from any location while providing advanced security measures like encryption and tokenization. These benefits make instant payment solutions a reliable choice for modern transactions.