PayPal app was launched in 1999, and it has become synonymous with electronic money transactions. It manages everything from online money transfers to checks and money orders. Transactions can be made in any global currency. It is considered one of the most reliable fintech app for getting payment if you are a freelancer or a remote worker, especially in a foreign country.

While lots of new competitors have entered the growing online payment market, PayPal is firmly holding its numero uno position as a market leader. Here is a list of the latest statistics that surely backs up the above-mentioned fact.

- PayPal currently has almost 300 million active users.

- The average PayPal user conducts 36.9 transactions per year.

- More than 87.5% of online buyers use PayPal.

- If it were a bank, PayPal would be the 21st largest bank in the US.

- The average PayPal user has $485 in their account.

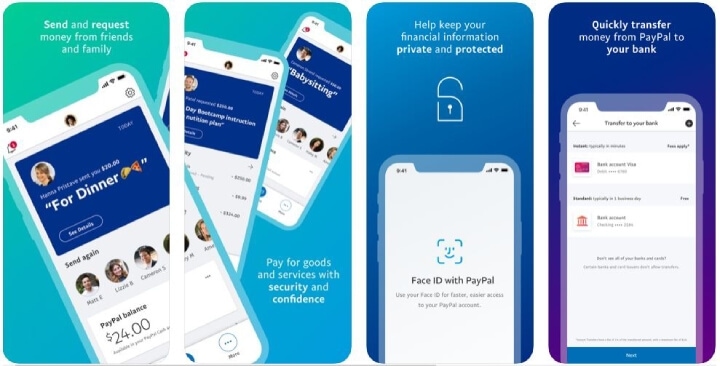

In this era of digitalization and convenience, money transactions also happen via smartphones. This is where the PayPal app comes into the picture. The app is available for android as well as iPhone users. It allows users to check the balance in their accounts and transfer funds from and to their associated savings and checking accounts or debit and credit cards. The information on your PayPal account stays confidential and secure.

There are three kinds of accounts in the PayPal App:

- Personal: This is for sending and receiving cash.

- Business: This is for monitoring a user’s business account and sharing invoices.

- Mobile Point of Sale: This is for accepting credit cards and using a touchless mode of payments using a phone or tablet.

Link: (Web, iOS, Android)

Essential features for a mobile payment app like PayPal

PayPal offers an array of unique features that simplifies transactions for both customers and merchants. The company keeps on updating these features based on the feedback and customer response. We have discussed the essential ones below:

Interactive and easy UI: One of the USPs of this app is its interactive and easy user interface. After registration, a user simply needs to click ‘Send’ or ‘Receive’ for transactions. Even other features are simple and take not more than five minutes to understand.

Multiple Currency Support: A feature like this inevitable to transactions could be done between two parties located in different regions of the world.

Invoicing: There’s an in-built feature to create and send an invoice. The merchant can add contact information, logo, and other custom fields to his/her invoice template. Quick access to this template is allowed for future transactions. Tracking payments and billing history are quite straightforward.

One Touch™: The PayPal prevents the users from entering their login details each time they purchase something using this app. It uses its fraud protection and Buyer Protection features to ensure the details of the user are completely safe.

Instant Transfer: By charging a nominal amount, PayPal lets its users transfer funds instantly to Visa or MasterCard.

QR Code: Each PayPal account has a unique QR code that can be shared to receive money. The users need to visit the “Share” tab for this purpose. By scanning this QR code, the senders can easily transfer money to the recipient. Apple’s Camera app lets the users do so directly through their cameras.

PayPal.Me: To receive money from the customers, the professionals and businesses simply need to share the personalized link generated via PayPal.

Cloud integration: integration with cloud technology ensure quick and safe transactions. It ensures the users receive an array of functionalities through a single app.

Multiple emails by a single account: To offer more handiness and flexibility, PayPal lets the users provide eight email addresses linked to one bank account. This also makes it difficult for cybercriminals to attack an account.

Designing guidelines to make a mobile payment app

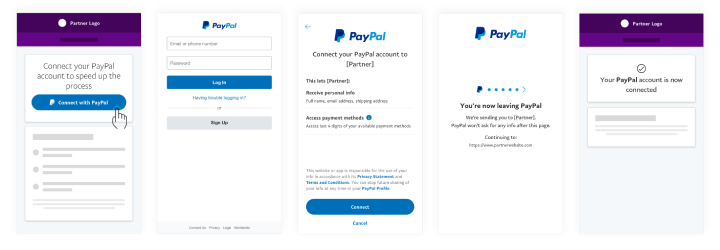

Due to the presence of various transaction and security features, designing an app like PayPal can be a bit complicated. You need a team of UI designers, business analysts, web developers, Android developers, and iOS developers for the best results. For mobile and web app infrastructure, you also need a managed cloud service solution.

Apart from this, you require an API/SDK solution to implement significant payment features. A reliable app development that offers comprehensive solutions can take of majority of these requirements. Just make sure you get transparent pricing and easy-to-understand contract.

How does PayPal generate revenue?

The main source of revenue is through fees related to domestic and international transactions. The fees charged for different services by PayPal are discussed below:

Sending money to friends or a family member

When a US-based PayPal account holder sends money to another user in the US, he/she has to pay 2.9% of the amount and a fixed fee as the funding fees. The fees are applicable when the transaction is done via debit card, credit card, or PayPal Credit.

The funding fees increase if a US-based account holder sends money to the non-US account holder. PayPal also levies transaction fees separately for international transactions.

Transaction fees for selling goods

For online transactions: When an online retailer sells services or goods using PayPal account for receiving the funds, he/she has to pay 2.9 percent of the transaction amount, along with a fixed fee. This applies to the funds coming from the US. For the funds coming out of the US, the 4.4-per cent fee is levied.

For offline transactions: A fee of 2.7 percent of the sale is levied on the seller if the amount is coming from an account in the US. For the accounts outside of the US, the fee is 4.2 percent.

PayPal Pro

It’s an upgraded version of online transaction services for businesses. It includes features like a virtual terminal to receive payments over the phone or email. The businesses need to pay 30 dollars as a monthly fee for PayPal Pro. Talking specifically about Virtual Terminal, PayPal charges 3.1 percent, along with 0.30 dollars for each domestic transaction. For cross-border transactions, an additional 1.5 dollars are charged.

Additional services

A monthly fee of 10 dollars is charged for recurring billing service. For advanced fraud protection services, ten dollars of the monthly fee, along with 0.05 dollars per transaction, has to be paid.

Interests from money deposited

Money kept by users’ as PayPal balance is used by the company as a deposit in liquid investments which provides interest. This serves as another source of revenue for PayPal.

Why PayPal is the most popular mobile payment app?

It is a combination of several factors that have established PayPal as one of the global leaders in terms of online payment systems. The crucial ones among them include:

Trust among the customers

The customers prefer using PayPal service because they don’t have to share their Credit or Debit Card numbers with the merchants. This ensures a sense of security among the majority of users. In case of disputes with the merchant, the time it takes to receive the money-back is shorter when compared to issues arising due to Credit/Debit Card transactions. No joining fee for using PayPal services is another crucial factor in this regard.

Acquisition of competitors

Acquiring the business of competitors is one of the strategic moves by PayPal to maintain its market dominance. Acquisition of iZettle in 2018 has helped the fintech giant in strengthening its foothold in Europe and Latin America. Through its acquisition of GoPay with a 70% stake, it was able to penetrate the Chinese market. Other notable companies acquired by PayPal include Venmo, Paydiant, Xoom, and Modest.

The motive behind a few acquisitions was to become more robust technologically. Recently, the company has acquired Honey Science Corporation, a shopping rewards platform, to enhance the shopping experience of customers.

Global use

The company has its presence in more than 200 countries worldwide. This scope of expansion has enabled small businesses and freelancers to send and receive payments from their clients and vendors situated in different parts of the globe. The international presence of this level also aids in establishing trust among new users.

Referral programs

PayPal was the first online firm to launch referral programs. During its earlier days, the company witnessed a growth of 7-10 percent each day through referrals. As a result, their user base crossed 100 million members. This strategy was mimicked by numerous other online brands, including Dropbox. Even today, it launches such programs where the users get rewarded for referring the app to their friends. Several cashback options on various services and products are also instrumental in expanding the services in new markets.

Virtual Terminal & Payflow

When compared to other online transaction services, the fee for receiving money is lesser. With the virtual terminal facility, the merchants need not purchase a card swiper to accept credit or debit cards from their customers. Nor do they need to install any software for this purpose. The integration of PayPal with shopping carts is quite simple. The businesses can also set up an option of recurring payments using this service.

Technology Stack

PayPal like app alternatives that are widely used by people globally

Money makes the world go around. Whether you need to pay your utility bills or transfer funds to a friend or family member or receive a payment or purchase something online, the easier it is to transact the better. There are a few more apps for electronic money transfer apart from PayPal. Here we will talk about what’s special about them.

Apple Pay

This app is specifically for iOS users. The payment methods used here are credit or debit cards only. The credit card transaction fee is 3 percent and the debit card transaction is free of cost. Users can transfer up to $10,000 at a time. The latest iOS phone users have this app already installed on their smartphones. One of the severe limitations of this app is that you can transfer money only to and from iOS users. Money can be transferred to your business account in 1 to 3 days.

Link: (Web)

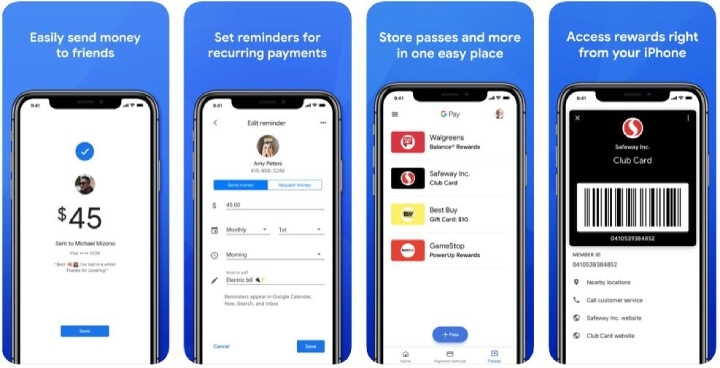

Google Pay

Google has reorganized Android Pay and Google Wallet into a single service called Google Pay. Recently, this app has gained popularity among the users due to reward and referral features. It is also one of the cheapest online currency transaction apps on the list. Bank transfers and debit card transactions are free and 2.9 percent fees are levied on credit card transactions.

It’s integration with other Google services that makes google pay stand out. For Android users, a messaging function can be used to pay or request a payment.

Link: (Web, iOS, Android)

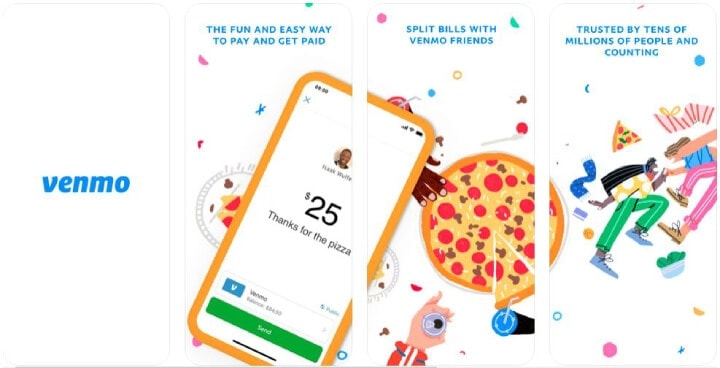

Venmo

Venmo is one of the highly social apps for electronic currency transfer. Once you create an account on Venmo, it asks you to add your friend, this step is helpful when you try to transfer money to or from those friends. Another social feature of Venmo is that you can make a transaction public if you want to.

For credit card transactions, you will have to pay 2.9 percent. Venmo has recently added a feature for faster transaction. Users can send money to their debit card instantly for 25 cents.

Link: (Web, iOS, Android)

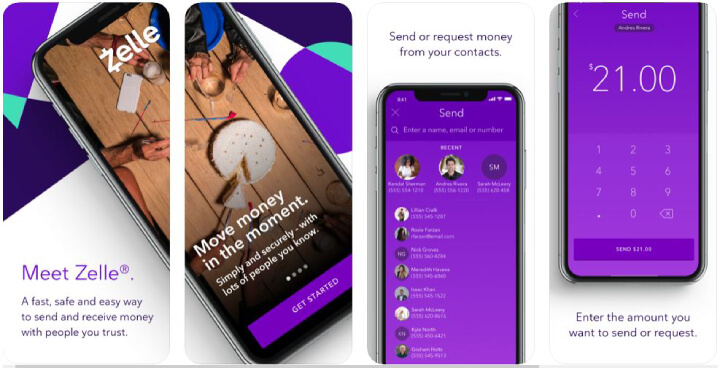

Zelle

Zelle was launched in June 2017. It is a faster way to transfer money between most of the US banks. It is compatible with 30 banks in the USA and is integrated with many banking apps. This app is not able to accept international debit cards or deposit accounts.

Link: (Web, iOS, Android)

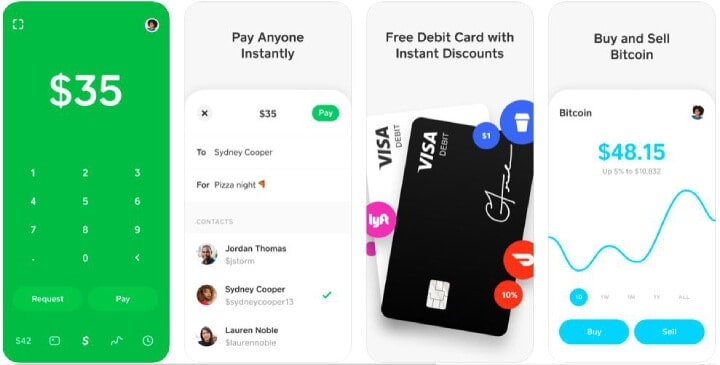

Square Cash

This app is built by Square. It can be integrated with email. Users can request a payment by sending an email to the person or business. User doesn’t have to set-up an account to use Square Cash. A bank account cannot be used for the transaction. Only debit cards or credit cards can be used to make a transaction using this application.

Link: (Web, iOS, Android)

Conclusion

The demand and requirement for mobile payment apps are increasing day by day – not only businesses and freelancers are using them, but millennials have also developed a trend of using these apps with time. So, if you’re thinking to run a business, which requires an app like PayPal, get in touch with one of the top mobile app development companies to get started.