Electric vehicles solved one fundamental question: what powers the car? But a more profound transformation is now underway, the one that redefines what the car actually is. Welcome to the era of Software-Defined Vehicles (SDVs), where automobiles evolve from hardware products frozen at production into updatable, connected compute platforms on wheels.

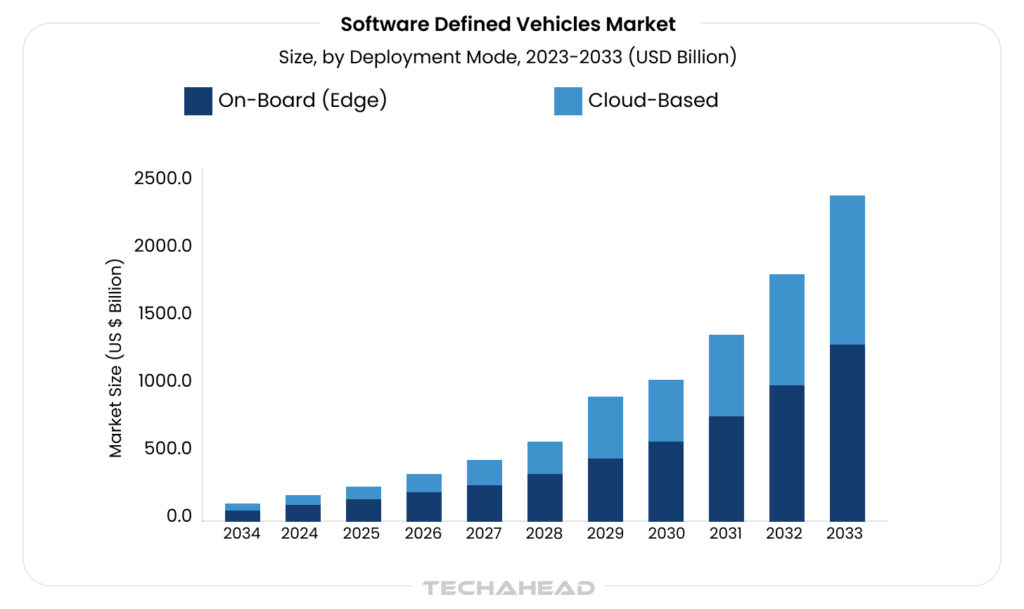

The market signals are unmistakable!

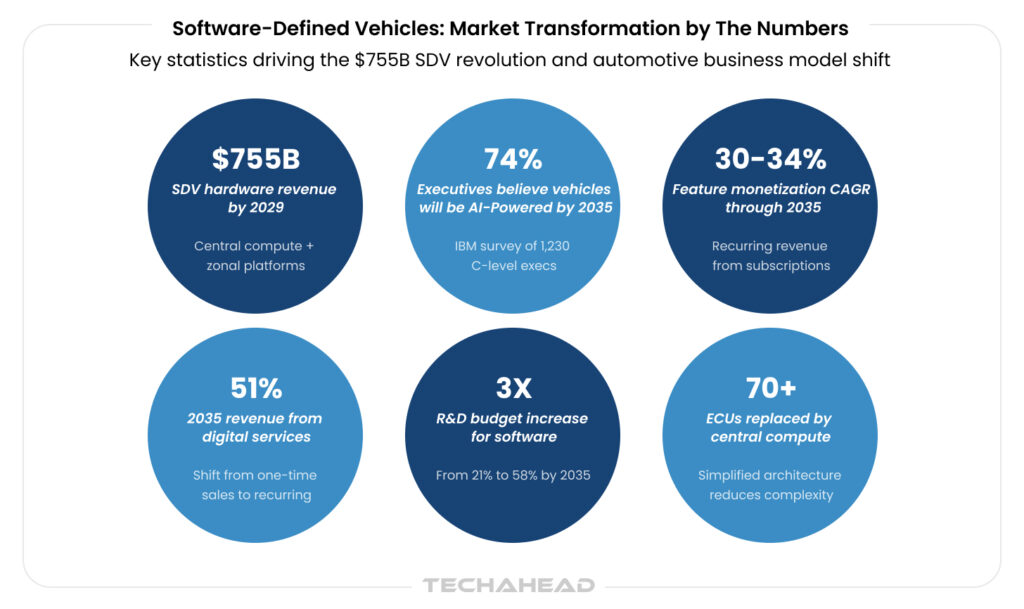

According to IDTechEx’s comprehensive research, SDV-related hardware revenue, including central compute platforms, domain and zonal controllers, and connectivity infrastructure, is projected to reach approximately $755 billion by 2029.

Key Takeaways

- Software-Defined Vehicle or SDV hardware revenue projected to reach $755 billion globally by 2029

- 74% of automotive executives believe vehicles will be software-defined and AI-powered by 2035

- Feature-based SDV monetization growing at remarkable 30-34% CAGR through 2035

- Central compute plus zonal architectures replacing 70+ distributed ECUs in modern vehicles

- AI-driven predictive maintenance and smart diagnostics remain under-deployed despite high potential

- Automotive R&D budgets for software will triple from 21% to 58% by 2035

- 51% of 2035 automotive revenue expected from recurring digital and software services

This isn’t just incremental growth; it represents a fundamental restructuring of automotive competition. Meanwhile, feature-based monetization enabled by SDV architectures is forecast to grow at an astounding 30-34% CAGR through 2035, reaching hundreds of billions in cumulative revenue.

IBM’s 2024 “Automotive 2035” study, based on surveys of 1,230 C-level automotive executives across nine countries, reveals the industry’s conviction about this shift: 74% of executives believe that by 2035, vehicles will be software-defined and AI-powered.

More strikingly, 75% say the software-defined experience will be the core of brand value, not horsepower, not styling, but software sophistication.

Here’s the critical reframe: Electric vehicles are the entry ticket to tomorrow’s automotive market. Software-defined, AI-first architectures are the long-term competitive moat that will determine which automakers thrive and which become commodity manufacturers in an increasingly software-centric industry.

We at TechAhead empower OEMs, Tier-1 suppliers, and mobility startups navigate this transition by building the connected experiences, data platforms, and AI-driven features that sit on top of SDV stacks, spanning mobile companion apps, cloud services, and in-vehicle applications that unlock the full potential of software-defined mobility.

What Is a Software-Defined Vehicle, Really?

As IBM’s automotive research defines it: A software-defined vehicle (SDV) is a modern automobile in which core functions and features are controlled, updated, and enhanced through software rather than fixed hardware systems.

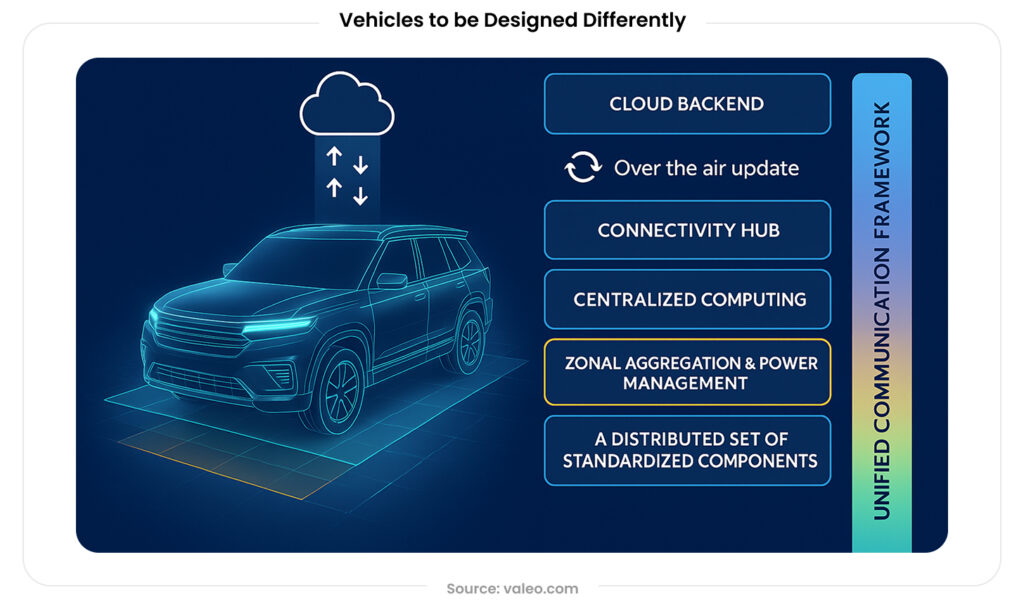

How Software-Defined Vehicles Are Made

This seemingly simple definition represents a revolutionary architectural shift from how vehicles have been designed and manufactured for over a century.

From Legacy ECUs to Central Compute

Traditional vehicles rely on 70+ individual Electronic Control Units (ECUs) scattered throughout the vehicle, each controlling narrow functions: One for brakes, another for airbags, yet another for climate control.

These ECUs communicate via low-speed CAN and LIN networks, creating a fragmented architecture where:

- Functionality is hardware-bound: Changing vehicle behavior requires replacing physical components

- Updates are rare and costly: Software updates mean dealership visits and expensive service procedures

- Integration is difficult: Cross-domain features (like coordinating powertrain with safety systems) require complex ECU-to-ECU communication

- Validation is prolonged: Testing every possible ECU interaction becomes exponentially complex as systems multiply

SDVs fundamentally restructure this paradigm through:

Central High-Performance Compute (HPC) Platforms

Powerful computing nodes, leveraging processors from NVIDIA, Qualcomm, and others, consolidate workloads that previously required dozens of separate ECUs.

These HPC platforms deliver computational power measured in hundreds of TOPS (Trillions of Operations Per Second), enabling real-time AI inference for perception, planning, and control.

Zonal Controllers

Rather than distributed domain controllers, zonal architectures organize vehicle electronics by physical location. A front-zone controller manages all sensors, actuators, and functions in the front of the vehicle, a rear-zone controller handles the back, and so on. This topology dramatically reduces wiring complexity and cost.

High-Speed In-Vehicle Networks

Automotive Ethernet (100 Mbps to multi-gigabit speeds) replaces slow CAN/LIN buses, enabling the bandwidth required for camera feeds, LiDAR data, and high-resolution displays. C-V2X (Cellular Vehicle-to-Everything) connectivity links vehicles to infrastructure and cloud services.

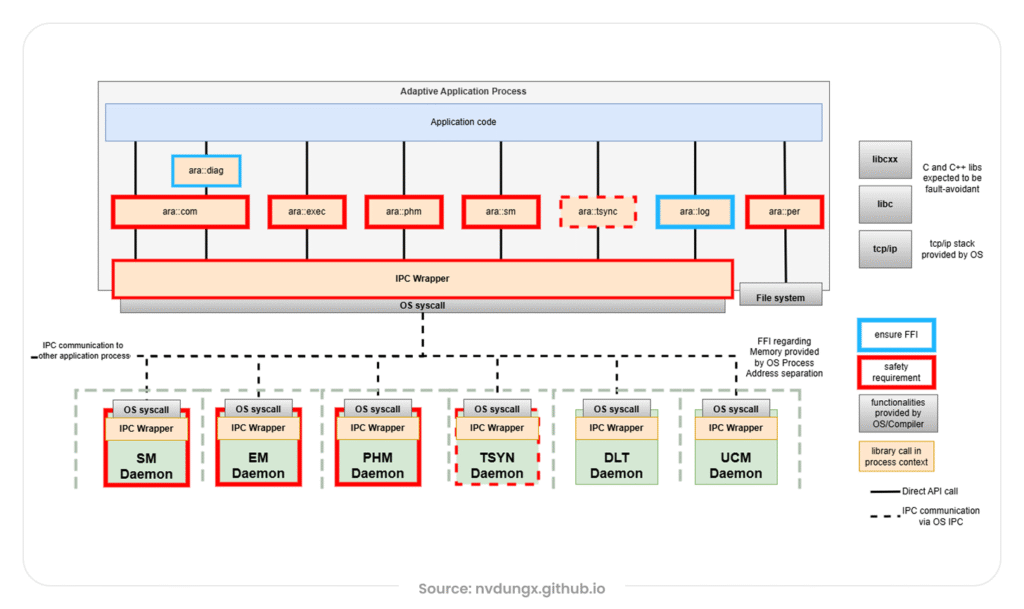

Virtualized Software Environments

Container technology, hypervisors, and AUTOSAR Adaptive enable app-like deployment models where software functions can be updated, added, or removed over-the-air without touching hardware.

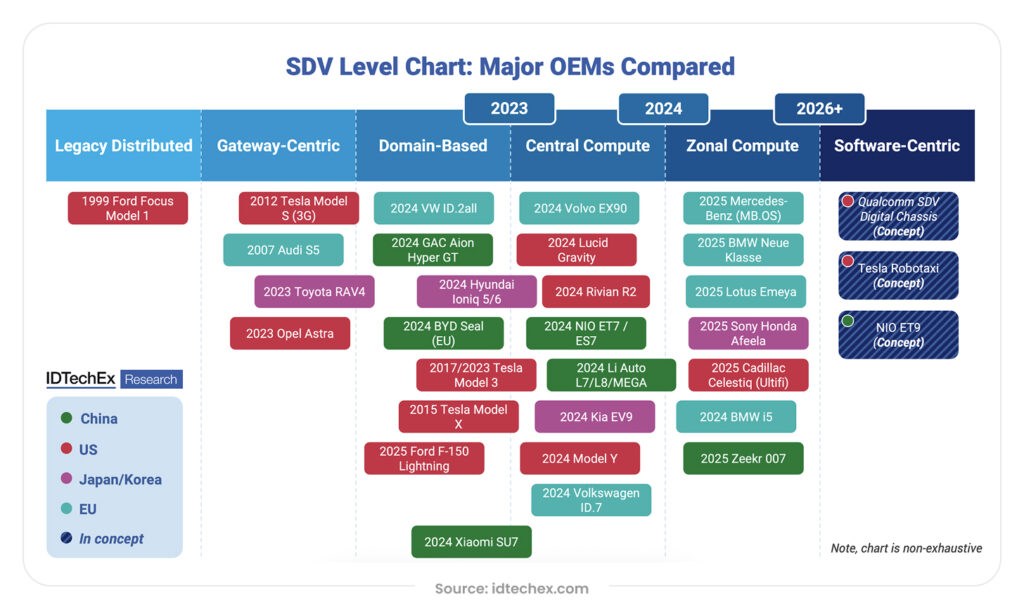

According to IDTechEx analysis, platforms like BMW’s Neue Klasse, Tesla’s refreshed Model Y, and Rivian’s next-generation vehicles exemplify this central compute + zonal architecture evolution, representing the production roadmap for SDV implementation at scale.

Core SDV Characteristics

What truly defines a software-defined vehicle?

- Centralized Computing Architecture: Consolidated compute platforms replacing distributed ECUs

- Over-the-Air (OTA) Updates: Continuous software deployment throughout vehicle lifecycle

- AI-Powered Functions: ADAS, personalization, predictive maintenance running on-board

- Connectivity as Foundation: V2X communication enabling cloud services and fleet learning

- Hardware-Software Decoupling: Features defined in software, independent of underlying hardware

The result? Vehicles that improve after purchase, much like smartphones, gaining new capabilities, performance enhancements, and safety features through software updates alone.

Why AI-First Architectures Are the New Automotive OS

Software-defined capabilities enable continuous improvement, but artificial intelligence services transforms SDVs from programmable machines into learning systems that adapt, personalize, and optimize in ways impossible with traditional rule-based software.

Source: TechAhead AI Team

AI as the Value Engine

IBM’s “Automotive 2035” research reveals that automotive executives expect R&D budgets allocated to software and digital development to nearly triple, up from 21% currently to 58% by 2035. Much of this investment will fund AI capabilities across multiple vehicle systems:

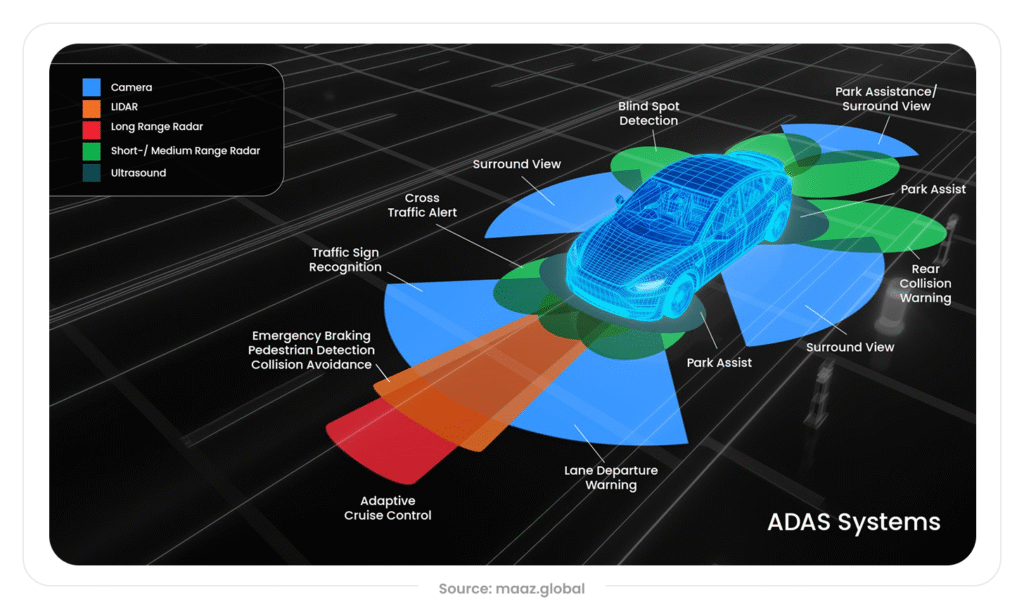

Advanced Driver Assistance and Autonomy

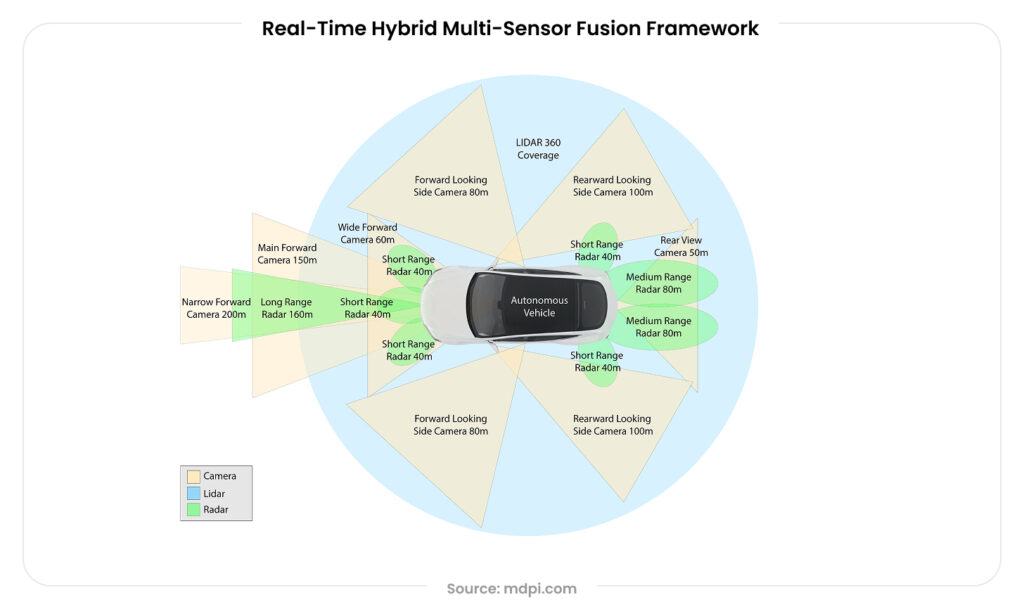

Real-time sensor fusion from cameras, radar, and LiDAR feeds neural networks performing object detection, path planning, and decision-making. These perception systems must process gigabytes per second of data with millisecond latency, requirements that only centralized, AI-optimized compute platforms can satisfy.

Smart Diagnostics and Predictive Maintenance

AI models continuously monitor vehicle health through thousands of sensors, detecting anomalous patterns that precede failures. Instead of fixed maintenance schedules, vehicles predict when components need service, reducing downtime and extending asset life. Through agentic AI development services, enterprises can build intelligent vehicle systems where autonomous AI agents monitor operational data, trigger maintenance workflows, and optimize asset performance in real time. IBM highlights predictive maintenance as a use case where AI extends beyond driving assistance to core vehicle operations.

Dynamic Performance Calibration

AI optimizes powertrain behavior, energy management, thermal control, and ride comfort based on driving conditions, driver preferences, and learned patterns. For EVs especially, AI-driven energy management can extend range by 10-15% through intelligent battery thermal management and regenerative braking optimization.

Personalized In-Cabin Experiences

Generative AI powers intelligent voice assistants that understand natural language, context, and user preferences. Systems from NVIDIA and Qualcomm enable adaptive UX where displays, seating positions, climate settings, and content recommendations automatically adjust based on who’s driving and their current context.

Why Architectures Must Be AI-First, Not AI Added Later

The distinction between “AI-first” and “AI-added” architectures is critical. Legacy vehicles with limited compute can run simple AI models for specific tasks.

But the AI capabilities defining next-generation SDVs, vision transformers processing multiple camera streams, large language models powering conversational interfaces, reinforcement learning optimizing energy management, demand architectural foundations designed for AI from inception.

This means:

- AI Accelerators Integrated: GPUs, NPUs (Neural Processing Units), and specialized AI chips embedded in central compute platforms

- Hardware-Agnostic Software Frameworks: Abstraction layers enabling models to run across different accelerator types without rewriting code

- High-Bandwidth Data Paths: Ethernet backbones supporting terabytes of daily sensor data flowing to AI processors

- Edge-Cloud AI Orchestration: Distributing inference between vehicle and cloud based on latency, privacy, and computational requirements

The 2025 European SDV Technology Roadmap emphasizes that in-vehicle AI frameworks must abstract hardware dependencies and support multiple accelerators, a key recommendation ensuring automakers aren’t locked into single silicon vendors and can upgrade AI capabilities as technology advances.

The Progression: From Generative AI to Physical AI

Industry analysis from Automotive-iQ describes an evolution: today’s generative AI interfaces (conversational assistants, content generation) represent just the first wave. The progression continues toward agentic AI, systems that autonomously accomplish multi-step tasks on behalf of users, and ultimately physical AI where vehicles act as autonomous agents within broader mobility ecosystems.

Autonomous driving exemplifies physical AI: the vehicle perceives its environment, reasons about optimal actions, and executes physical maneuvers, all with minimal human input. This represents embodied intelligence operating in the real world, dependent on AI infrastructure solutions for its very existence.

Reference Architecture: From Distributed ECUs to Central Compute + Zones

Understanding SDV architecture requires examining both hardware topology and software layers that together enable software-defined functionality.

Hardware Evolution: Central + Zonal

Legacy Topology: Dozens of discrete ECUs connected via low-speed CAN/LIN buses. Each ECU tightly couples software to specific hardware, making updates difficult and cross-domain coordination complex.

SDV Topology: High-performance central compute nodes plus zonal controllers connected via Gigabit Ethernet, consolidating workloads and enabling cross-domain features. This architecture reduces wiring harness weight by up to 30%, cuts component costs, and dramatically simplifies software deployment.

IDTechEx projects this transition will drive the $755 billion hardware revenue opportunity by 2029, as automakers retool production lines and redesign electrical/electronic (E/E) architectures around central compute platforms.

Logical Software Stack

1. Hardware Layer

Central compute SoCs optimized for AI inference (NVIDIA Drive, Qualcomm Snapdragon Ride), zonal controllers managing local sensors/actuators, high-resolution displays, and V2X connectivity modules.

2. Operating System and Middleware

AUTOSAR Adaptive, Linux-based systems, POSIX OS variants, container runtimes (Kubernetes), and hypervisors enabling virtualization. IBM’s approach emphasizes uniform platforms spanning from vehicle to cloud, supported by Red Hat Enterprise Linux and OpenShift, allowing “build once, deploy anywhere” flexibility.

3. AI and Data Layer

Model deployment runtimes, data logging infrastructure, event processing pipelines, and OTA update mechanisms for both software and AI models. Safety-compliant recertification flows ensure updated models meet automotive safety standards (ISO 26262, UL 4600).

4. Application and Service Layer

Infotainment systems, driver assistance UIs, mobile companion apps, cloud services, and subscription management platforms. This layer is where TechAhead typically engages with OEMs, designing user-facing experiences that unlock SDV capabilities through intuitive, connected digital products.

Connectivity, OTA, and Continuous Deployment

Over-the-air updates transform vehicles from static products into continuously evolving platforms. But effective OTA requires more than uploading software files. According to IBM and Qt research, robust SDV OTA systems incorporate:

- Differential updates: Transmitting only changed components, not entire software images

- Fail-safe mechanisms: Ensuring vehicles remain drivable even if updates fail

- Cybersecurity controls: Encrypted, authenticated update packages preventing malicious code injection

- Virtualized testing environments: Validating updates in simulation before fleet deployment

- Automated recertification: Ensuring updated software maintains safety compliance

IBM’s DevOps approach for SDVs emphasizes CI/CD (Continuous Integration/Continuous Deployment) practices adapted from software industries, enabling automakers to test and deploy updates weekly or even daily, a radical departure from traditional multi-year development cycles.

Concrete AI Use Cases Turning Cars into “Rolling Computers”

Intelligent Driving and Safety

ADAS to Autonomy

AI-powered Advanced Driver Assistance Systems: Lane keeping, adaptive cruise control, automatic emergency braking, rely on real-time sensor fusion and perception.

IBM and S&P Global highlight these as core SDV capabilities, with central compute platforms from NVIDIA and Qualcomm providing the AI horsepower for perception and planning algorithms.

Modern ADAS processes inputs from 10+ cameras, 5+ radar units, and potentially LiDAR, fusing data into coherent environmental models updated 30-60 times per second. Only centralized, AI-optimized compute makes this feasible.

Level 3+ Autonomy

Higher automation levels demand even more computational capacity. Tesla’s Full Self-Driving (FSD) system exemplifies this: its neural network processes 8 camera feeds, generating driving decisions from learned representations of road geometry, traffic patterns, and pedestrian behavior.

IDTechEx forecasts automakers will charge up to 50% more for Level 3 autonomy (autonomous in certain conditions) compared to Level 2, creating substantial monetization opportunities for AI-enabled autonomy features.

Predictive Maintenance and Smart Diagnostics

Despite their transformative potential, IBM’s “Automotive 2035” study found that smart diagnostics, predictive maintenance, and performance calibration rank among the most promising yet under-deployed AI use cases in current SDVs.

Practical Implementation

AI models continuously monitor sensor data, vibration analysis detecting bearing wear, thermal patterns indicating cooling system degradation, battery voltage fluctuations predicting cell failures.

When patterns match failure precursors, systems alert drivers and schedule service appointments automatically, often before drivers notice symptoms.

For fleet operators, predictive maintenance delivers outsized value: a delivery company with 10,000 vehicles gains visibility into upcoming maintenance needs weeks in advance, optimizing service scheduling and minimizing unplanned downtime.

Personalized, AI-Driven In-Cabin Experiences

Generative and Conversational AI

Automotive-iQ and IDTechEx coverage highlights intelligent in-car assistants as a key SDV differentiator. These go far beyond voice commands for navigation or climate control. Modern generative AI systems:

- Understand complex, multi-turn conversations with contextual awareness

- Provide information synthesis across vehicle systems (combining route data, energy status, calendar appointments)

- Generate content like itinerary summaries, email drafts, or entertainment recommendations

- Learn user preferences and proactively suggest actions

NVIDIA and Qualcomm both offer automotive AI platforms specifically optimized for running large language models within vehicles, enabling these conversational capabilities without constant cloud connectivity.

Adaptive Digital Environments

OEMs are deploying full-width displays (like Mercedes-Benz Hyperscreen) and customizable digital cockpits backed by AI personalization. The system learns which information each driver prioritizes, how they prefer displays organized, and what shortcuts they use most, adapting the interface automatically.

Cross-Device Continuity

Consider a TechAhead-designed scenario: your mobile app tracks your morning routine, learning you typically leave for work at 7:45 AM. The car’s AI system preemptively warms up in winter, adjusts seat positions, and queues your preferred podcast.

During the drive, it suggests optimal routes based on real-time traffic and your meeting schedule. After parking, the mobile app guides you through the office building. Cloud AI learns from these multi-device journeys, continuously refining suggestions.

Energy and Performance Optimization in EVs

AI for Energy Management

Range anxiety remains the primary EV adoption barrier. AI addresses this through dynamic optimization: analyzing terrain ahead, weather conditions, traffic patterns, and driver behavior to optimize regenerative braking, climate control power draw, and battery thermal management.

Real-world results show AI-optimized energy management can extend range 10-15% compared to rule-based systems, the difference between making it to a destination or running out of charge.

Over-the-Air Performance Tuning

Tesla pioneered post-sale performance upgrades: downloading improved acceleration profiles, enhanced autopilot features, and optimized energy efficiency. BMW, BYD, NIO, and others now pursue similar strategies, unlocking features through software that physically exist in the vehicle but require payment to activate.

This model generates recurring revenue while enabling customers to upgrade capabilities without buying new vehicles, a win-win enabled entirely by SDV architectures.

Implementation Blueprint: How CIOs/CTOs Should Move in 2026

Step 1: Define the AI-First SDV Vision

Prioritize AI use cases aligned with brand positioning and customer value. The IBM and IDTechEx research suggests focusing on:

- Smart diagnostics and predictive maintenance for fleet operators and high-value customers

- Personalization and in-cabin AI for premium consumer segments

- ADAS and safety enhancement for regulatory compliance and differentiation

- Energy optimization for EV competitiveness

Step 2: Modernize Architecture Foundations

Embrace central compute + zonal strategies in next-generation vehicle platforms. Invest in in-vehicle AI frameworks that abstract NPU/GPU dependencies, as recommended by European SDV roadmaps, ensuring flexibility as accelerator technology evolves.

Partner with semiconductor vendors (NVIDIA, Qualcomm, NXP) to access reference architectures, but maintain abstraction layers preventing vendor lock-in.

Step 3: Build Automotive CI/CD and OTA Capabilities

Establish pipelines for continuously testing and deploying software and AI models using virtualized environments. IBM and Qt emphasize that simulation-based validation dramatically reduces time-to-market and risk compared to traditional hardware-in-the-loop testing alone.

Implement fail-safe OTA mechanisms ensuring vehicles remain operational even when updates fail, and automate recertification workflows confirming updated systems maintain safety compliance.

Step 4: Design Experience and Data Platforms

Treat the vehicle as a node in a broader digital ecosystem spanning mobile apps, cloud services, and connected infrastructure. Custom software development companies like TechAhead excels at designing companion apps, driver portals, and data platforms that surface SDV intelligence to users and operations teams.

This layer translates raw vehicle data into actionable insights: mobile apps showing energy efficiency trends, service scheduling portals with predictive maintenance alerts, fleet dashboards aggregating utilization patterns across thousands of vehicles.

Step 5: Pilot, Learn, Scale

Begin with 1-2 focused “hero” features, for example, predictive maintenance plus AI-powered cockpit personalization. Deploy to limited production volumes, instrument thoroughly, and use telemetry to validate impact on target KPIs.

Once proven, expand across vehicle trims and geographic markets, continuously refining models based on real-world performance data.

2026-2030 Outlook: The Road Ahead for AI-Defined Mobility

From Connected EV to AI-Defined Mobility Node

NTT DATA’s SDV foresight emphasizes that data- and AI-driven transformation will make AI the key driver of change in automotive over the coming years, fundamentally altering vehicle architecture, user experience, and societal mobility patterns.

Vehicles won’t just be connected, they’ll be intelligent participants in mobility ecosystems, coordinating with infrastructure, other vehicles, and cloud services to optimize traffic flow, energy distribution, and urban logistics.

Ecosystem Milestones

Industry roadmaps project-specific technology adoption timelines:

- ~2027: Widespread adoption of high-speed Ethernet backbones in mainstream vehicles

- ~2028: Consolidated hardware platforms with abstraction layers becoming standard practice

- 2030+: Zonal architectures prevalent across OEM portfolios, with the majority of new vehicles qualifying as SDV Level 3 or higher

Evolution of AI in Vehicles

Automotive-iQ predicts a progression from today’s generative AI interfaces (conversational assistants, content generation) to agentic AI (autonomous task execution) and ultimately physical AI where vehicles operate as autonomous agents coordinating complex mobility missions with minimal human oversight.

This trajectory mirrors broader AI trends: from narrow task automation to general-purpose assistants to embodied intelligence operating in the physical world.

Conclusion: The Imperative for Action

Leaders who treat vehicles as software- and AI-defined platforms, not merely as electric powertrains, will control the most defensible competitive positions and stickiest customer relationships in tomorrow’s automotive industry.

The window for strategic positioning is narrowing. As IBM’s research shows, executives expect the transition to accelerate rapidly, with some suggesting the software-defined future will arrive sooner than 2035, there by forcing the automakers to confront transformation challenges immediately.

TechAhead serves as the partner that helps turn SDV strategy into reality, building AI-powered digital products across the entire vehicle ecosystem (mobile apps, cloud platforms, in-vehicle experiences) and establishing the data and integration foundations that enable continuous innovation throughout the vehicle lifecycle.

Ready to accelerate your software-defined vehicle strategy? Contact TechAhead to explore how we can help transform your automotive platforms with AI-first architectures, connected experiences, and data-driven monetization models that define the future of mobility.

An SDV is a vehicle where core functions are controlled and updated through software rather than fixed hardware systems.

EVs change the powertrain; SDVs transform the entire vehicle into an updatable, AI-powered computing platform with continuous improvements.

Recurring revenue through subscriptions, reduced hardware costs, faster feature deployment, personalized experiences, and continuous post-sale value creation.

Hardware-software decoupling complexity, cybersecurity risks, cultural shift from mechanical to software-driven development, and talent acquisition in competitive markets.

High-speed Ethernet adoption by 2027, consolidated platforms by 2028, and zonal architectures prevalent from 2030 onwards across OEMs.