“Achieving truly decentralized finance – power to the people – is a noble & important goal.” – Elon Musk.

If you are managing enterprise finances, you have likely experienced frustration. Despite technological advancements, approximately 30% of cross-border payments still take more than one business day to settle. Traditional banking inefficiencies cost global corporations billions annually in transaction fees. Moreover, the global banking industry remains stagnant at a price-to-book ratio of approximately 0.9, the lowest of all industries; this signals deeper systemic inefficiencies that directly impact your bottom line.

However, Decentralized Finance (DeFi) offers a compelling alternative. DeFi ecosystems eliminate intermediaries, enabling near-instantaneous settlements. Total Value Locked (TVL) in DeFi protocols stabilized around $60 billion in early 2025, as banks and asset managers recognized its potential for treasury operations. The question for enterprise leaders today is not whether to explore DeFi, but how to implement it strategically. That is why in today’s blog, we are going to explain the benefits & challenges of implementing DeFi for enterprises.

Key Takeaways

- One-third of cross-border payments take over one business day, costing enterprises $120 billion annually in traditional transaction fees.

- DeFi uses blockchain and smart contracts to enable direct, transparent financial transactions without banks or brokers as middlemen.

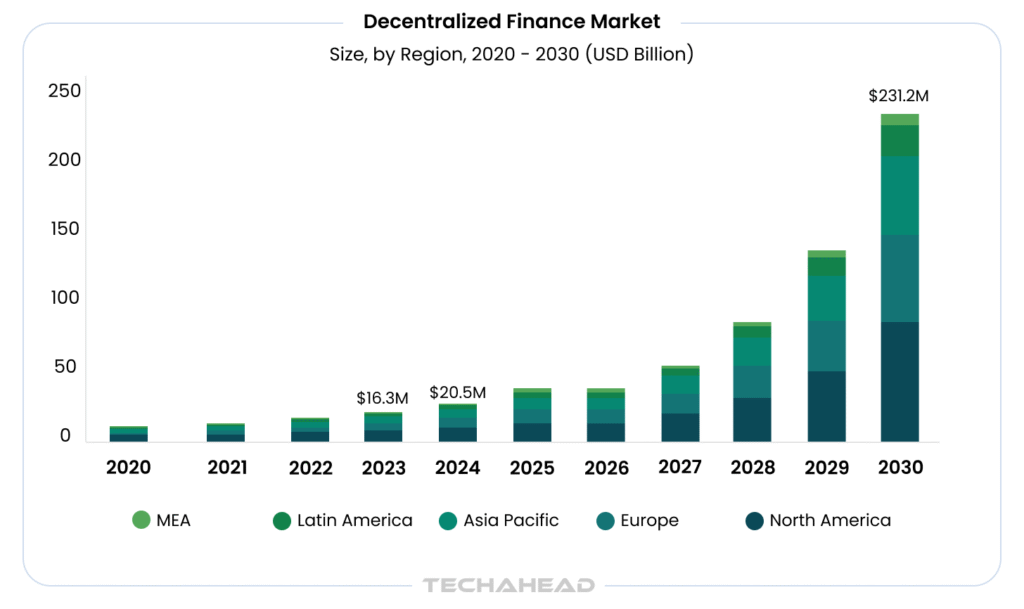

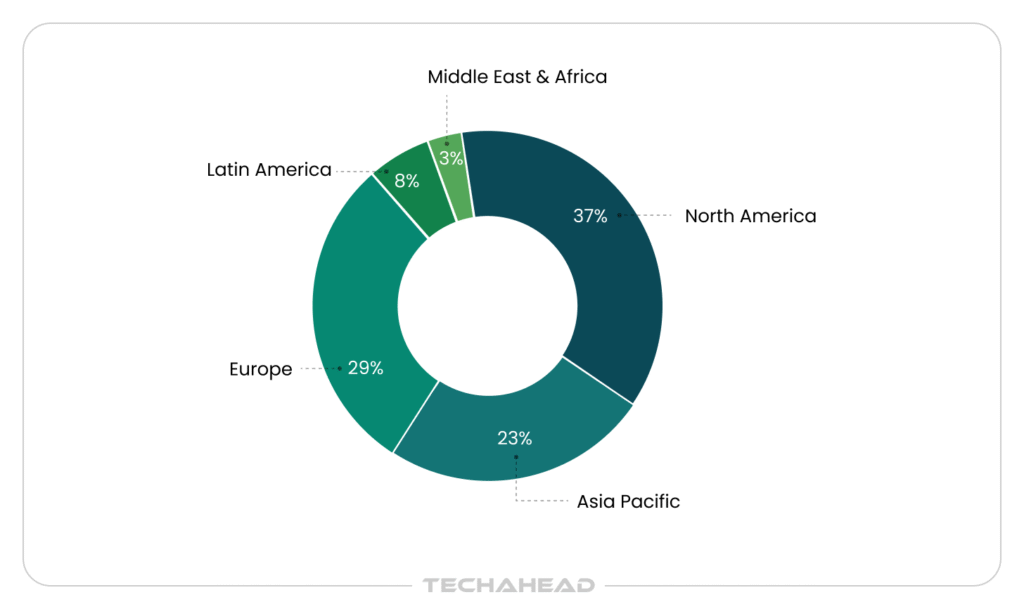

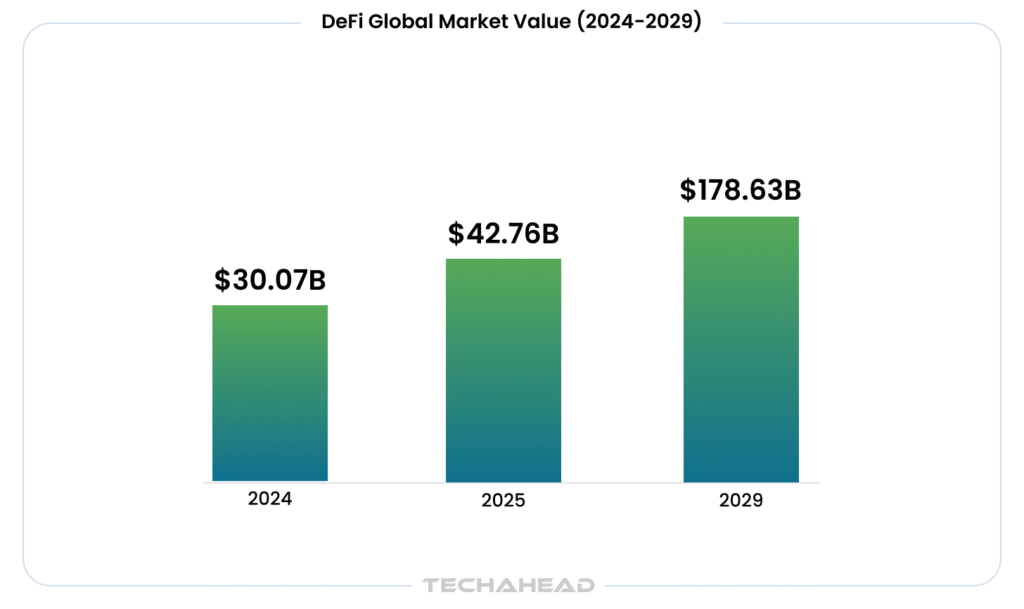

- The global DeFi market is expected to grow from an estimated $26.94 billion in 2025 to $231.19 billion by 2030, at a 53.7% CAGR.

- DeFi creates a trustless environment, replacing manual paper approvals with secure, self-executing code that guarantees accurate transactions.

- Successful DeFi implementation requires strategic planning, choosing reliable institutional-grade platforms, and gradual footprint expansion aligned with risk tolerance.

What is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, is a blockchain-based financial system that operates without traditional intermediaries like banks, brokers, or exchanges. Instead of relying on centralized institutions to facilitate transactions, DeFi uses smart contracts, self-executing code on blockchain networks. It means you can lend, borrow, trade, and invest directly with other users through transparent protocols.

According to Grand View Research and other sources, the global decentralized finance market size was estimated at approximately USD 31.5 billion in 2025 and is projected to reach USD 231.19 billion by 2030, growing at a CAGR of 53.7% from 2025 to 2030.

For enterprise owners, it means a fundamental shift in how financial operations could work that potentially reduces costs. Here are the key features of DeFi:

- Permissionless Access: Anyone with an internet connection and, digital wallet can access DeFi platforms without approval from banks.

- Transparency: All transactions are recorded on public blockchains that allow you to verify every transaction in real-time.

- Interoperability: DeFi protocols seamlessly interact with each other. It allows you to build complex financial strategies.

- 24/7 Availability: Unlike traditional banking systems with operating hours, DeFi platforms run continuously to execute financial transactions.

- Reduced Intermediary Costs: You can lower transaction fees, processing times which improve your cash flow management.

How DeFi Works: Blockchain & Smart Contracts

In DeFi, two core technologies drive the ecosystem: blockchain and smart contracts.. They are the backbone of this ecosystem. Let’s dive in:

Blockchain Technology

Think of blockchain as a distributed digital ledger. Unlike the traditional banking system which centralizes records, blockchain records every transaction across multiple nodes simultaneously. This prevents data manipulation, providing an immutable record of every financial activity.

What are Smart Contracts?

Smart contracts are programs that automatically enforce agreements when pre-defined conditions are met. For instance, if you are working with a supplier, instead of waiting for invoices and payment approvals, you can program the payment to release automatically once goods are delivered.

How It Works in Practice:

- You deposit funds into a DeFi protocol; the smart contract holds them securely.

- Conditions are set based on your agreement.

- Automatic execution upon meeting conditions.

- Eliminate manual processing

Why Does This Matter for Your Enterprise?

The blockchain makes sure that once a smart contract is deployed, nobody can tamper with its code. It creates a trustless environment; you do not need to trust the other party or the platform because the code guarantees execution exactly as programmed. This automation replaces paperwork approval chains, ensuring faster settlements in financial workflows.

Traditional Finance (TradFi) vs Decentralized Finance (DeFi): Key Differences

Understanding how DeFi differs from traditional finance is essential. Here is a comparison of the two systems and what each means for your business operations:

| Aspect | Traditional Finance (TradFi) | Decentralized Finance (DeFi) |

| Control | Centralized institutions (banks, brokers) control your funds | You maintain full control of your assets through self-custody wallets |

| Access | Requires approval, documentation, credit checks to open accounts | Permissionless; anyone with internet access can participate instantly |

| Availability | Limited to business hours, banking days | Operates 24/7/365 with no downtime or holidays |

| Transaction Speed | Can take 1-5 business days for settlements, especially internationally | Near-instant settlements within minutes |

| Costs | Multiple intermediary fees, wire charges, currency conversion costs | Lower fees with no middlemen, though network gas fees apply |

| Transparency | Opaque systems; you cannot see behind-the-scenes operations | Fully transparent; all transactions visible on public blockchains |

| Trust Model | You must trust the institution to handle your funds properly | Smart contracts execute automatically without human discretion |

| Regulation | Heavily regulated with consumer protections, insurance (FDIC) | Less regulated then TradFi, but increasing compliance tools & frameworks |

| Accessibility | Geographic restrictions, compliance requirements limit access | Accessible from anywhere without geographic barriers |

| Customer Support | Dedicated support teams, dispute resolution, fraud protection | No centralized support,, transactions are irreversible once executed |

7 Key Benefits of Decentralized Finance (DeFi) for Enterprises

Every CFO asks the same question: what’s the real value? Indeed, beyond the hype, DeFi offers practical solutions to real enterprise challenges. Traditional banking was not built for modern enterprise digital transformation needs. DeFi bridges these gaps to improve your bottom line.

1. Enhanced Liquidity Management

DeFi platforms allow you to put capital to work immediately through yield-generating protocols. Instead of letting cash sit in low-interest business, you can use funds on DeFi lending platforms for better returns.

2. Programmable Payment Solutions

Design customized payment logic; from milestone-based releases to recurring subscriptions, smart contracts automate complex payment structures without manual intervention.

3. Global Workforce Payments

Paying international contractors becomes seamless with DeFi. You can send payments across borders instantly without dealing with correspondent banks. Avoid high wire transfer fees or currency conversion markups.

It means your team in the USA or Asia can receive payment at the same speed as your local employees.

4. Access to Alternative Funding

DeFi opens doors to decentralized lending platforms where you can secure loans using crypto assets as collateral. This provides a diversified funding channel, reducing reliance solely on traditional bank credit lines.

5. Fractional Ownership Opportunities

Through tokenization you can divide high-value assets into smaller tradeable units. As a result, you can offer partial ownership of company assets or real estate. Without tokenization, the asset would otherwise remain illiquid for a global audience.

6. Streamlined Audit

With every transaction permanently recorded on-chain, audit trails are immutable and instantly verifiable. This significantly reduces administrative overhead for your finance team during reconciliation.

7. Protection Against Currency Volatility

For enterprises operating internationally, DeFi offers access to stablecoins (cryptocurrencies pegged to fiat currencies). You can hold, transfer in digital dollars without exposure to crypto volatility. It protects your business from exchange rate fluctuations.

TL;DR of the Real-World Business Applications

| Platform | Function | Benefit |

| Aave | Decentralized Lending & Borrowing | Instant borrowing/lending without intermediaries. |

| Lido Finance | Liquid Staking | Earn rewards while keeping funds usable. |

| Uniswap | Decentralized Exchange (DEX) | Low-cost trading; you retain full control. |

| Polymesh | Asset Tokenization | Turns real-world assets into compliant tokens. |

| Synthetix | Synthetic Derivatives | Trade stocks and commodities on blockchain. |

| Polymarket | Prediction Markets | Bet on events with fast, transparent payouts. |

What are the Real-World Business Applications of DeFi?

When you think about real-world business applications of DeFi, several popular platforms come to mind that show just how versatile this technology has become.

Aave

One of the industry titans is Aave, a decentralised liquidity platform that allows you to lend your crypto assets or borrow instantly without intermediaries. It leverages V3 smart contracts and the native GHO stablecoin to automate the process while offering features like Flash Loans for capital efficiency.

Lido Finance

Another popular example is Lido Finance, which offers liquid staking, which allows you to stake assets like ETH but still have liquidity by receiving a token that represents your staked assets. It helps you maximize returns without locking up funds.

Uniswap

Uniswap is a leading decentralized exchange (DEX) where you can trade tokens directly with others. Now running on V4 architecture, it introduces “Hooks” that drastically reduce gas costs. Here, you do not need to rely on a centralised entity. It minimises fees, puts you in full control of your assets.

Polymath

Polymesh (formerly Polymath)

Polymesh (evolved from Polymath) is an institutional-grade blockchain built specifically for asset tokenization. It turns things like real estate and corporate debt into tradable blockchain tokens using the CDD (Customer Due Diligence) standard. Now managed by Polymesh Labs, it opens compliant, regulated investment opportunities for your enterprise

Synthetix

Platforms like Synthetix let you trade synthetic derivatives and give you exposure to traditional assets like stocks, commodities, all on the blockchain.

Polymarket

Lastly, Polymarket is a decentralized prediction market where you can speculate on real-world events. Following a record-breaking year driven by global elections, Polymarket now processes billions in monthly volume. Everything from political outcomes to economic trends is traded on Layer 2 networks to ensure speed and low costs, with smart contracts automating payouts transparently.

Key Challenges Enterprises Face in Adopting DeFi

You have learned the advantages of Decentralized Finance; however, you may also face challenges during the adoption of DeFi, such as:

Regulatory Uncertainty

The biggest concern for most enterprise owners is navigating the complex global regulatory frameworks surrounding DeFi. While the EU’s MiCA regulation has provided clarity in Europe, financial regulations still vary dramatically across other jurisdictions. Additionally, complying with new standards like the Digital Operational Resilience Act (DORA) becomes problematic if you operate across multiple countries with different regulatory stances.

Technical Complexity

Implementing DeFi needs your team to develop entirely new skill sets. Your finance department needs to understand blockchain technology, wallet management, and how to interact with AI-driven smart agents. This steep learning curve, combined with the need for rigorous smart contract audits and top cybersecurity services, slows adoption.

Scalability

While Layer 2 solutions have reduced costs, blockchain networks can still face congestion bottlenecks. For enterprises processing numerous daily transactions, managing liquidity across fragmented networks makes financial planning challenging. What seems cost-effective on one chain may become complex when bridging assets during peak demand, often requiring specialized cloud consulting services to optimize infrastructure

How Enterprises Can Leverage DeFi to Transform Financial Operations?

You do not have to choose between traditional finance and DeFi; the smartest approach for most enterprises is to adopt a hybrid model. Start integrating DeFi for specific use cases rather than transforming the entire financial ecosystem.

For example, you might begin with tokenizing Real-World Assets (RWAs) or using stablecoins for cross-border payments. These initial steps allow you to test the waters and build internal expertise before committing larger resources.

Keep your primary operations running through established banking channels that use DeFi as a complementary tool, such as your payroll, tax payments, etc. For this, you need to partner with institutional-grade DeFi platforms. As your team gains confidence, you gradually expand your DeFi footprint that matches your risk tolerance.

Conclusion

Decentralized finance is a strategic opportunity to reimagine your enterprise’s financial infrastructure. Indeed, challenges like regulatory uncertainty and integration complexity exist, but the potential benefits are substantial. The key is approaching DeFi implementation with the right strategy and technical partner.

At TechAhead, our team specializes in building secure, scalable DeFi solutions integrated with the latest AI and Layer 2 technologies tailored to your specific business requirements. Ready to explore how DeFi can transform your operations? Let’s discuss your blockchain strategy today.

Yes, most jurisdictions treat DeFi transactions as taxable events. You’ll need to report gains, losses, and income from lending or staking. Consult a crypto-savvy tax professional.

Only use audited, reputable protocols with proven track records. Verify smart contract addresses, avoid platforms promising unrealistic returns, and conduct thorough due diligence before depositing funds.

Yes, several protocols offer decentralized insurance coverage against smart contract failures and hacks. Traditional insurers are also beginning to offer crypto custody insurance for enterprises.

Unlike banks, there’s no password recovery. If you lose your private keys, your funds are permanently inaccessible. Implement robust security protocols and consider multi-signature wallets.