AI and Cognitive Tech Change Insurance Industry

Worldwide, the use of AI technology is transforming various industries and sectors, and the Insurance sector is one of them. With the rise of the digital economy, insurtech companies aren’t the only ones relying heavily on AI tools and Big Data. Research by Genpact points to around 87% of traditional insurance companies investing over $5 million per year on AI.

Moreover, approximately 82% of the companies were planning to shift their business processes to AI within the next three years. Among the reasons why insurers use AI are for optimizing efficiencies, whether it’s to improve positive customer experience, detect fraud, manage risk or make better underwriting decisions.

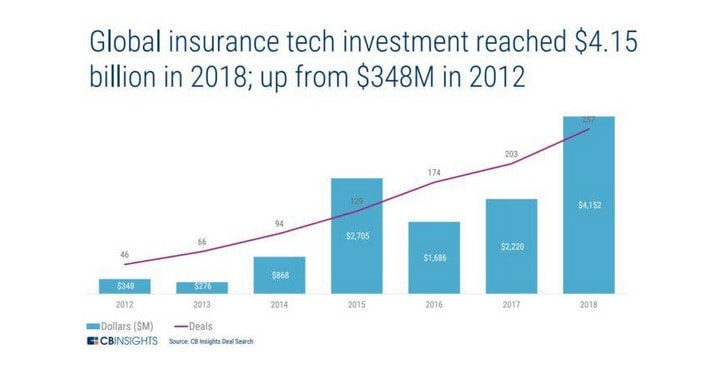

Image Credit: CBInsights

The Impact of AI Technology in Digital Insurance

AI-based technologies such as Machine Learning, Neural Networks, Natural Language Processing and Deep Learning find several applications in the insurance industry.

1. Chatbot: Intelligent Virtual Assistants

With their ability to resolve basic queries related to product inquiries, claims status, FAQs, and billing status, chatbots serve as intelligent virtual assistants that are available 24/7. By simplifying processes and enhancing customer experience, chatbots can help insurers make significant cost savings.

2. Cognitive Automation

By replicating the human thought process, cognitive automation utilizes AI technologies such as Natural Language Processing (NLP), pattern recognition, and image processing to automate specific processes across functions such as insurance sales, customer service, risk management, underwriting, claims management and regulatory reporting.

3. Predictive Analytics

With the help of data and models, predictive analytics focuses on predicting the various outcomes of a specific event. The tool can be used to provide insights into potential risks or for detecting the likelihood of a claim being fraudulent. Predictive analytics is based on data mining of actual events to identify the key variables that affect an outcome. Then, the variables are used to create static formulas. However, it can be combined with Machine Learning to improve the predictions of a specific outcome as adjustments are made to the formulas on an ongoing basis.

4. Natural Language Processing (NLP)

By analyzing the semantics of the human language, both spoken and written, NLP can have a far-reaching impact on customer service. In the long term, it can bring substantial cost savings by reducing the requirement for call center staff. Based on the analysis of a customer’s social media profile, NLP can help underwriters in drafting policies that fit a customer’s specific needs.

5. Computer Vision (Image and Video Analysis)

Based on Deep Learning, computer vision scans images or videos to recognize patterns. Its application in insurance extends to several tasks, including fraud detection by verifying the authenticity of documents, validation of damages to a property before processing claims and even underwriting a policy based on the record of a policyholder.

6. Connected Insurance and AI – The scope of IoT Data

By using data from IoT devices, AI helps to track usage patterns and risks, based on which customized offerings can be designed for individuals, whether it’s underwriting an insurance policy to suit the customer’s needs or preventing accidents or frauds.

What are the Benefits of Using AI in the Insurance Sector?

1. Personalization

The use of AI tools and data gathered from IoT-enabled devices as well as other sources of information can help companies get deeper insights into the profiles and behaviors of their customers. As a result, formulating personalized policies, new product offerings or even pricing insurance policies becomes easy.

2. Faster claims settlement

Currently, the process of settling claims involves extensive paperwork, which is time-consuming. AI and Machine Learning can help to automate some of the processes, thereby speeding up the processing time, from the moment a claim is reported right through to its validation and communication with the customer regarding the final settlement.

3. Decreased fraud occurrence

With the use of AI-based technologies such as facial recognition and sentiment analysis, identity theft and the risk of false claims can be eliminated to a large extent. Similarly, visualization and data analytics can be used to assess potential risk areas that cannot be detected by traditional tools, thereby reducing the likelihood of fraud.

4. Customer experience

Besides reducing the time involved in underwriting and claim processing, which are two of the main areas where customer’s face delays, the benefits of AI can extend to quicker processing of contracts as well as payment verification, saving customers time involved in communication to inquire about the status of the application or payment. Personalization of pricing is another area where AI can help in enhancing the customer experience. Data Analytics and Sentiment Analysis can provide better insights into the customer’s insurance needs as well as their sensitivity to various price points.

Conclusion

The significant investments that insurance companies are making in AI indicates that they see the benefits of adopting the technology to improve business efficiency. Some companies have already started applying AI-related technologies to specific processes, and in the future, the extent of AI implementation could extend to processes throughout the entire lifecycle to transform the way the insurance industry works.

TechAhead has worked with insurtech start-ups as well as global insurance leaders to develop Artificial Intelligence development and Blockchain app development solutions for improving business processes. Our team has experience in creating custom applications that use visual recognition, machine learning, and other AI tools that simplify the management of routine tasks, whether it’s underwriting, claims processing or customer experience.

TechAhead, a leading mobile app development company is known to deliver high quality mobile apps for all platforms and frameworks. Contact our experts now to take your business to the next level.